How to Identify Market Trends for Long-term Business Planning

Keeping up with industry trends is never easy – after all, you have a company to manage on a daily basis. However, it is important to recognise that the market is constantly evolving, and in order to remain ahead of the curve and stop competitors passing you by, you must be able to change with the times for the sake of long-term business planning.

Market trend analysis should not have to be as frightening as it might be. It’s basically a comparison of market data over a fixed time frame with the goal of identifying some recurring patterns or outcomes that could be used to map the company plan and match it with the industry’s overall trajectory. Surveys, interviews, and analyses of customer behaviour are examples of marketing research approaches that aid in understanding business patterns and behaviour.

PESTEL Analysis is a branch of trend analysis, which looks at the market’s political, economic, social, technological, environmental, and legal factors as they relate to consumer patterns.

Consumer preferences and behaviours have a major impact on market dynamics. You will assess the moves that could have a direct effect on your overall market success by conducting the following forms of industry trend analysis.

Use industry research and trend reports to your advantage

Reading research reports or solution guides is one of the best ways to improve your ability to spot patterns in the industry.

It is helpful to follow reputable business journals and papers. Data about the global economy is available from Forbes and Business Insider. You can also get quarterly reports from big consulting firms including McKinsey & Company, Bain & Company, and Deloitte. These are useful for identifying and comprehending megatrends. There could be other publications devoted to your business market, so doing proper research rather than focusing on the big names is a smart idea. Keep an eye on the business leaders as well, as they are always the first to notice trends as they always conduct original research and compile their results in one big report, and if you take the time to read it beyond the executive summary, you’ll almost always find something useful and important to what’s hot in your industry right now.

Utilise digital tools and analytics

If you’re a numbers geek, you’ll appreciate the wide range of analytical methods and apps at your disposal. It’s perfect because you can delegate all of the legwork to these tools, allowing you to grasp the broader picture of your business far more quickly.

- Social media research: Before they have an effect on the economy, consumer trends are often evident in social media. To get related industry trend research data on what’s trending and where the market could be headed, use resources like Sprout Social and Hootsuite Insights.

- Web analytics: Web analytics offer you a more detailed look at all kinds of patterns. Learn how companies in your industry group are impacted and compare yourself to them. You can measure almost any form of trend using real-time website traffic statistics and analytics. You can use metrics from commercial sources to cross-reference the details you find on social media and elsewhere.

- Google Trends is a fantastic free method for determining customer preferences for common goods and services.

Google Trends provides a long-term view of niche trends, while Google Keyword Planner lets you check for the most common keywords used online by your target audience, as well as the potential scale for using and bidding on such keywords for your company as part of a digital advertisement campaign.

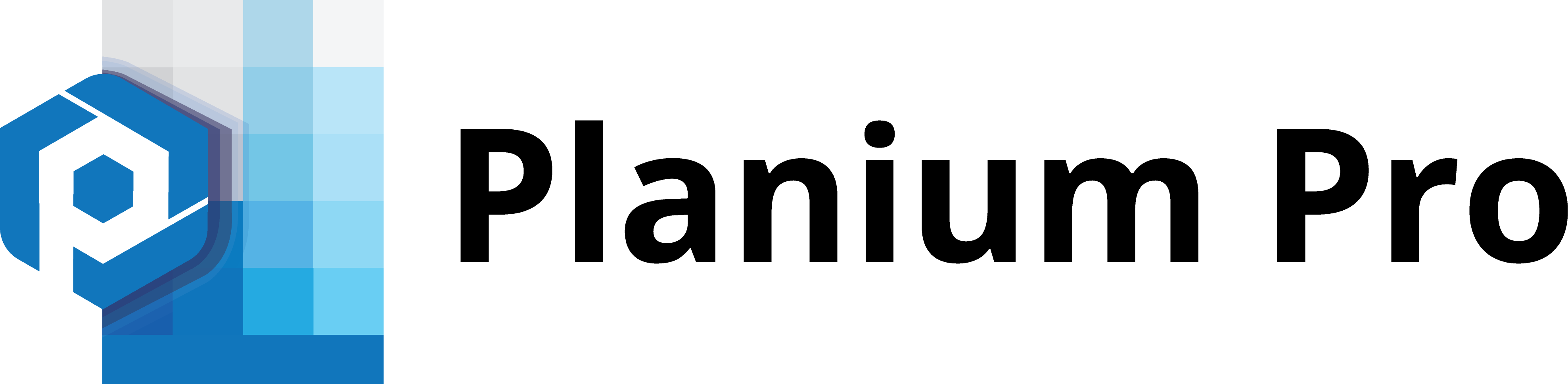

If you need assistance to compare your financials with the industry ones, Planium Pro offers ‘Industry benchmarking’ tool where you can look at the main financial metrics within the industry such as NOPAT to sales, Net interest cover (EBIT/ Int expense) and many more.

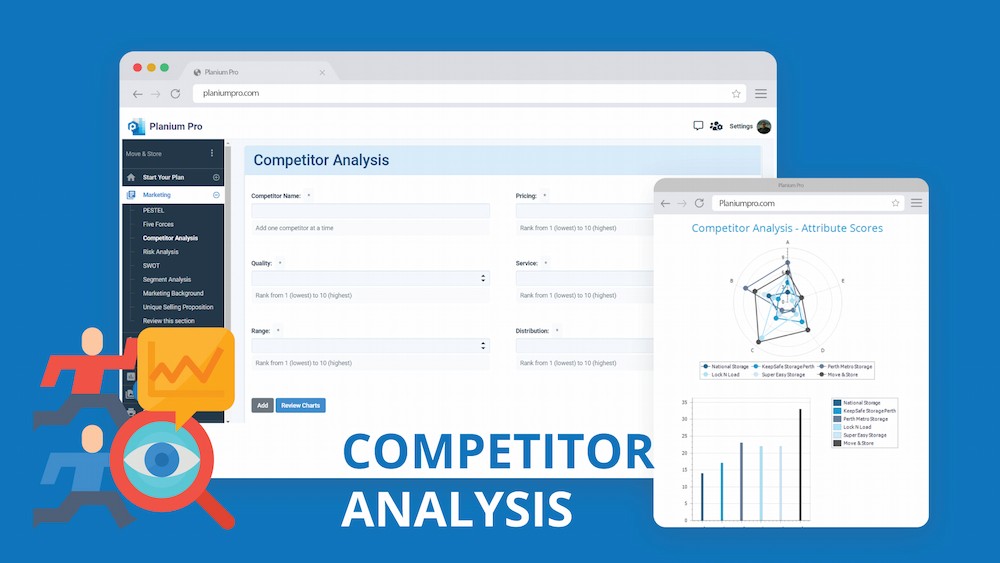

To stand out from the crowd, the most popular companies do not suit the crowd; instead, they innovate and break new ground. Observing and researching your competitors, on the other hand, will also give you a clear idea of their market positioning and whether they are responding to an emerging trend.

You may have listed the major players in your industry in the industry overview section of your business plan. However, not all of these companies would be in direct competition with you. Some may be in remote areas, while others may have pricing and delivery processes that are vastly different from those of a small company. As a result, you’ll concentrate your market research on firms that compete directly with you for sales – specific companies or brands that are direct competitors to your product or service in your geographic area. In certain cases, the competitors sell a product or service that the customer considers synonymous with yours (although, of course, you hope you hold the advantage with better quality, more convenient distribution, and other special features). If you run a local yoga studio, for example, you will face competition from other yoga studios within a 10-mile radius. You may want to include some competitors in your review who sell similar goods in a different market segment or who are farther away geographically.

Secondary data, as well as information from your sales team or other connections among your suppliers and customers, may provide a wealth of information about the strengths and weaknesses of competitors. The following is a list of basic competitor details that any business should be aware of:

- compare the size and market share of each competitor to your own

- how your target customers view or evaluate your competitors’ goods and services

- financial capacity of your competitors, which influences their ability to spend money on ads and promotions, among other items

- the skill and speed at which each competitor can develop new products and services

Interviewing competitor company executives, attending industry trade shows, and asking the right questions of industry ‘experts’ might be able to provide competitors’ company information, including for new companies. Experts may be prohibitively expensive as consultants, but they are happy to point you to free databases that you may not otherwise be aware of or have access to. Often, don’t forget about the competitors’ suppliers. They can be valuable sources of knowledge to help you with your research.

Trends shift industries every day, whether you’re ready for them or not. Knowing what’s on the horizon and adapting your business to keep up with those developments will help you stay competitive.

Other Resources

- ‘Competitive Analysis Definition – Entrepreneur Small Business Encyclopedia’ – https://www.entrepreneur.com/encyclopedia/competitive-analysis . Entrepreneur.

- Bergen, Mark. ‘Competitor Identification and Competitor Analysis: A Broad-Based Managerial Approach’ (PDF) – http://assets.csom.umn.edu/assets/71542.pdf

- Joan Magretta. ‘The Most Common Strategy Mistakes’. Harvard Business School. – https://hbswk.hbs.edu/item/6737.html